The AIA versus Tax Reform

That mammoth tax bill will have repercussions for years to come, but how will it affect architects? That’s the question I was asked to tackle for a recent piece in Architectural Record, specifically looking at what role the AIA’s lobbying arm played in securing policies friendly to architects, and how successful it was in those efforts:

That mammoth tax bill will have repercussions for years to come, but how will it affect architects? That’s the question I was asked to tackle for a recent piece in Architectural Record, specifically looking at what role the AIA’s lobbying arm played in securing policies friendly to architects, and how successful it was in those efforts:

In the aftermath of last year’s election—in which AIA CEO Robert Ivy quickly committed to work with the President-elect on behalf of the entire AIA member body, then just as quickly issued several apologies—the AIA learned how polarized and how vocal its membership was. When strategizing positions related to tax reform, the AIA recognized that its members were as varied in their views as the country’s population, representing every shade on the political spectrum. Thus the AIA chose to focus on three issues that would have ramifications for all architects, regardless of their party affiliation: fair treatment for architects under the new tax laws; protection of the Federal Historic Tax Credit; and the preservation of another tax credit, known as 179D, for efficient building. “The bill at large had the ability to impact all architects in different ways,” says Cindy Schwartz, a senior director for advocacy within the AIA. “We’ve limited our communications and our work to these specific issues.”

I also had the distinct pleasure of speaking with architect Marsha Maytum of Leddy Maytum Stacy Architects about historic credits, which her firm has leveraged in several Bay Area projects to achieve successful outcomes that would have been impossible without them:

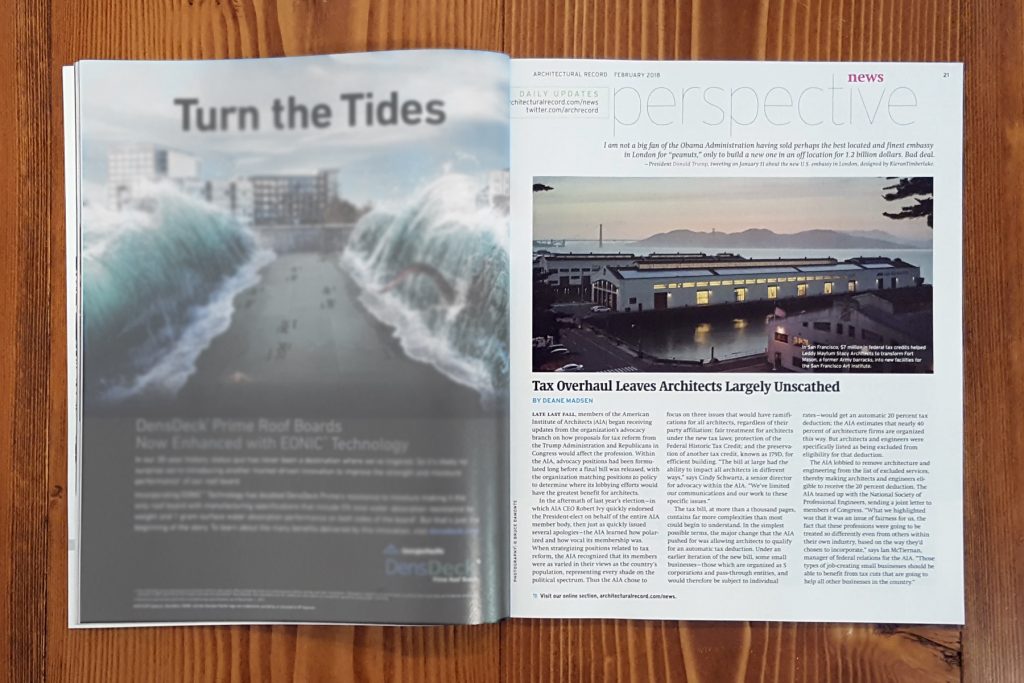

Without those tax credits, some projects simply wouldn’t happen, according to Marsha Maytum, FAIA, a principal with Leddy Maytum Stacy Architects in San Francisco as well as the incoming chair of the AIA’s Committee on the Environment. “Oftentimes, a landmarked building will have a lot of restrictions on what can and can’t be done to it, and if it’s not financially viable to rehabilitate it, it will just continue to decay,” Maytum says. “The tax credits provide some additional financial support to the organization trying to preserve the landmarked building.”

Read the full story at Architectural Record.